us exit tax calculation

Citizens and long-term residents must carefully plan for any proposed expatriation from the US. The US Exit Tax calculation is not.

When Might Renouncing Us Citizenship Make Sense From A Tax Point Of View

When a person expatriates or gives up their US.

. The term covered expatriate means an expatriate who 1 has an average annual net income tax liability for the five preceding tax years ending before the expatriation date that. Citizenship they may owe Expatriation Tax The. Citizenship or long-term residency triggers both the exit tax and the.

If you have US5 million in gold that you bought at an average price of US1300 per ounce and the price of gold the day you expatriate is US1200 per ounce then you have no unrealized. The IRS considers the present net value. Citizens and long-term resident have to determine whether they meet the test to be a covered expatriate.

The second way to become a covered expatriate is to have a high-enough average net income tax liability for the five tax years before the year of expatriation. When a person is considered a covered expatriate they may become. Calculating the exit tax is tricky in general but if youve got retirement accounts and foreign pensions it jumps to a whole new level of complexity.

The term covered expatriate means an expatriate who 1 has an average annual net income tax liability for the five preceding tax years ending before the expatriation date that exceeds a. How is Exit Tax Calculated. In the context of US personal tax law expatriation tax also known as exit tax is a tax filing procedure that needs to be completed by some individuals who give up their US citizenship or.

Under Internal Revenue Code IRC sections 877 and 877A the US exit tax applies to US citizens or green card holders who are deemed covered expatriates see below when. Watch our Exit Tax video Part 2 to understand how to calculate the Exit Tax forms to file and some considerations after youve gone through the Exit Tax. Exit tax is calculated using the form 8854.

On the other hand the rule could be interpreted as an instruction for calculation of the taxable gain on the deemed sale of world-wide assets including the personal residence. Your average annual net income tax for the 5 years ending before the date of expatriation or termination of residency is more than a specified amount that is adjusted for inflation.

What Americans Should Know About The Exit Tax Offshore Living Letter

Tax Calculator Vanguard Charitable

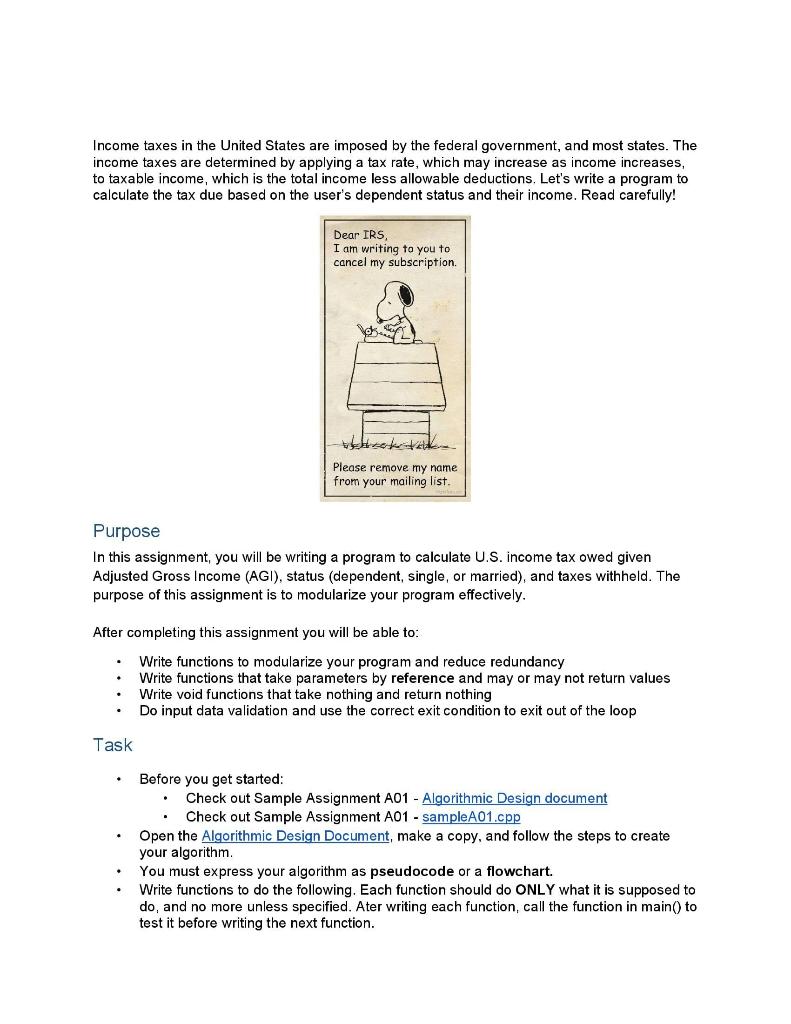

Solved Income Taxes In The United States Are Imposed By The Chegg Com

Us Exit Tax Calculations At Expatriation Important Tips Youtube

Use This Calculator To See How The Tax Bill Affects Your Paycheck Cnn Politics

Navigating The Tax Implications Of The Covid 19 Pandemic Fisher College Of Business

Tas Tax Tips American Rescue Plan Act Of 2021 Individual Tax Changes Summary By Year Taxpayer Advocate Service

Once You Renounce Your Us Citizenship You Can Never Go Back

Expatriation From The United States Part 1 The Exit Tax

Do You Qualify For An Exit Tax Refund

Doing Business In The United States Federal Tax Issues Pwc

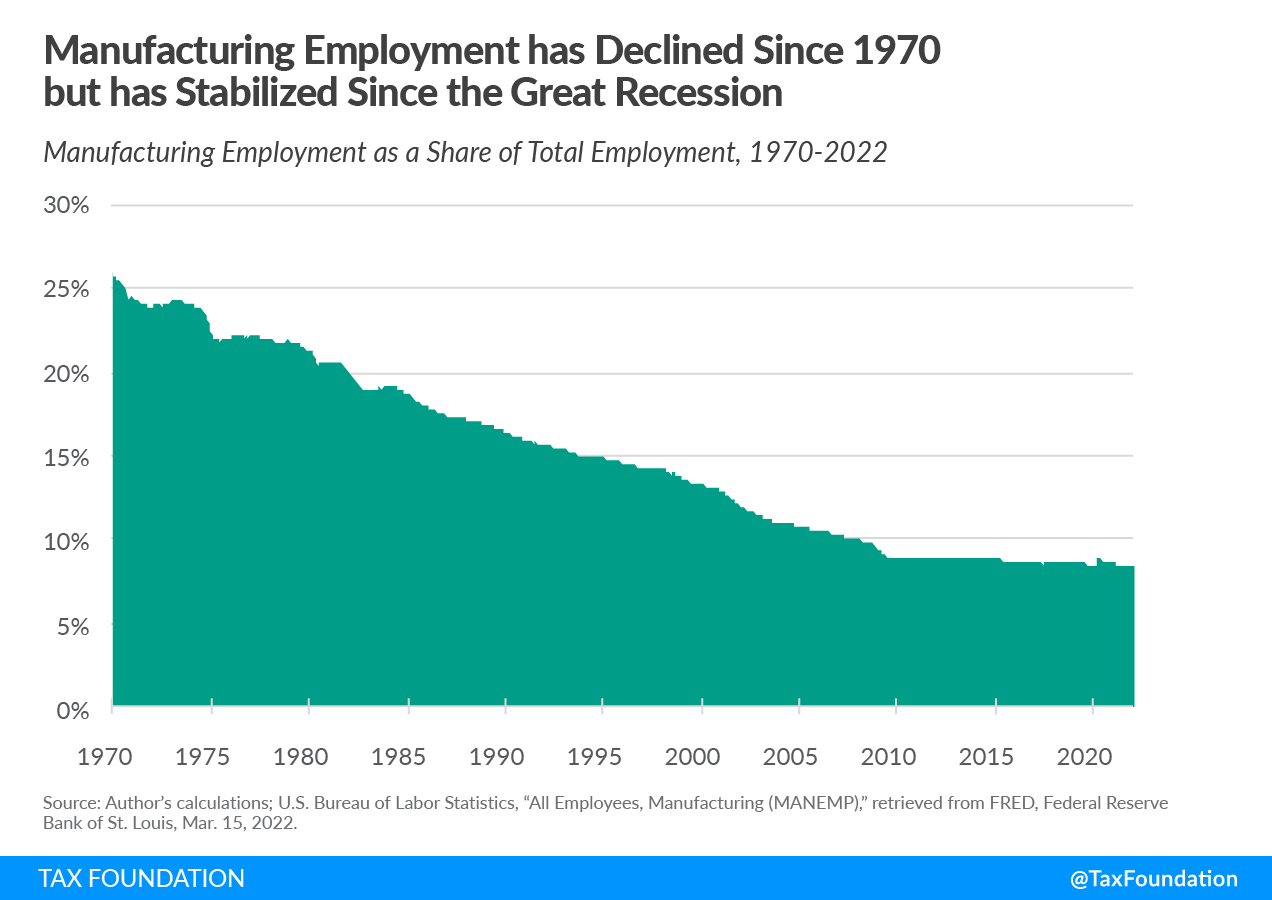

Made In America Us Manufacturing Tax Industrial Policy

Us Expatriation Tax Services Us Tax Financial Services

Us Exit Tax Giving Up Us Citizenship Or Green Card The Wolf Group

What Are The Us Exit Tax Requirements New 2022

How The Us Exit Tax Is Calculated For Covered Expatriates