rhode island tax table

The state sales tax rate in Rhode Island is 7 but you can customize this table as needed to reflect your applicable local sales tax rate. The average effective property tax rate in Rhode Island is 153 the 10th-highest in the country.

Wright S Dairy Farm And Bakery Rhode Island History Dairy Farms Rhode Island

Rhode Island Income Tax Forms at httpwwwtaxrigovtaxformspersonalphp.

. Check the 2022 Rhode Island state tax rate and the rules to calculate state income tax. Find your pretax deductions including 401K flexible account contributions. Income tax tables and other tax information is sourced from the Rhode Island Division of Taxation.

EMPLOYEES FROM WHOSE WAGES RHODE ISLAND TAXES MUST BE WITHHELD. The state sales tax rate in Rhode Island is 7 but you can customize this table as. Instead if your taxable income is less than 100000 use the Rhode Island Tax Table located on pages T-2 through T-7.

Tax Rate Starting Price Price Increment Rhode Island Sales Tax Table at 7 - Prices from 100 to 4780 Print This Table Next Table starting at 4780 Price Tax 100 007 120 008 140 010 160 011. Ad Compare Your 2022 Tax Bracket vs. Ad Get Ready for Tax Season Deadlines by Completing Any Required Tax Forms Today.

2022 Rhode Island Sales Tax Table. You can use our Rhode Island paycheck calculator to see what your take home pay will be after taxes. 3 rows The Rhode Island tax tables here contain the various elements that are used in the Rhode.

Rhode Island usually releases forms for the current tax year between January and April. The states sales tax rate is. Find your pretax deductions including 401K flexible account contributions.

RHODE ISLAND TAX RATE SCHEDULE 2018 TAX RATES APPLICABLE TO ALL FILING STATUS TYPES Taxable Income line 7 Over 0 62550 142150 But not over Pay--of the amount over 375 475 599 on excess 0 62550 142150. Tax Rate Income Range Taxes Due 375 0 to 66200 375 of Income 475 66200 to 150550 248250 475 599 150550 648913 599 over 150550. Find your gross income.

65250 148350 CAUTION. Show Sources Original Form PDF is httpstaxrigovmedia18626downloadlanguageen. A sales tax table is a printable sheet that you can use as a reference to easily calculate the sales tax due on an item of any price - simply round to the nearest 020 and find the row in the sales tax chart that shows the applicable tax for that amount.

Check the 2021 Rhode Island state tax rate and the rules to calculate state income tax. Of the on amount Over But Not Over Pay Excess over 0 66200 375 0 Use for all filing status types TAX If Taxable Income- Subtract d from c. The Rhode Island Tax Rate Schedule is shown so you can see the tax rate that applies to all levels of.

Download Or Email RI-1040NR More Fillable Forms Register and Subscribe Now. Find your income exemptions. Social Security is partially taxed while retirement accounts and pensions are both fully taxed.

62550 142150 CAUTION. Discover Helpful Information And Resources On Taxes From AARP. 4 rows The Rhode Island income tax has three tax brackets with a maximum marginal income tax of.

If you would like additional elements added to our tools. The Rhode Island tax tables here contain the various elements that are used in the Rhode Island Tax Calculators Rhode Island Salary Calculators and Rhode Island Tax Guides on iCalculator which are designed for quick comparison of salaries and the calculation of withholdings for typical employees and employers. Sales Tax Handbook 2022 Rhode Island Sales Tax Table A sales tax table is a printable sheet that you can use as a reference to easily calculate the sales tax due on an item of any price - simply round to the nearest 020 and find the row in the sales tax chart that shows the applicable tax for that amount.

RHODE ISLAND TAX RATE SCHEDULE 2020 TAX RATES APPLICABLE TO ALL FILING STATUS TYPES Taxable Income line 7 Over 0 65250 148350 But not over Pay--of the amount over 375 475 599 on excess 0 65250 148350. DO NOT use to figure your Rhode Island tax. Less than 100000 use the Rhode Island Tax Table located on pages T-2 through T-7.

Your 2021 Tax Bracket To See Whats Been Adjusted. We last updated Rhode Island Tax Tables from the Division of Taxation in January 2022. How to Calculate 2022 Rhode Island State Income Tax by Using State Income Tax Table.

The state is not a very tax-friendly state for retirees. The Rhode Island Tax Rate Schedule is shown so you can see the tax rate that applies to all levels. Find your income exemptions.

This page has the latest Rhode Island brackets and tax rates plus a Rhode Island income tax calculator. The Rhode Island Tax Rate Schedule is shown so you can see the tax rate that applies to all levels of taxable income. Rhode Island state income tax rate table for the 2022 - 2023 filing season has three income tax brackets with RI tax rates of 375 475 and 599 for Single Married Filing Jointly Married Filing Separately and Head of Household statuses.

Any income over 150550 would be taxes at the highest rate of 599. 1 The employees wages are subject to federal income tax withholding and 2 Any part of the wages were for services performed in Rhode Island. How to Calculate 2021 Rhode Island State Income Tax by Using State Income Tax Table.

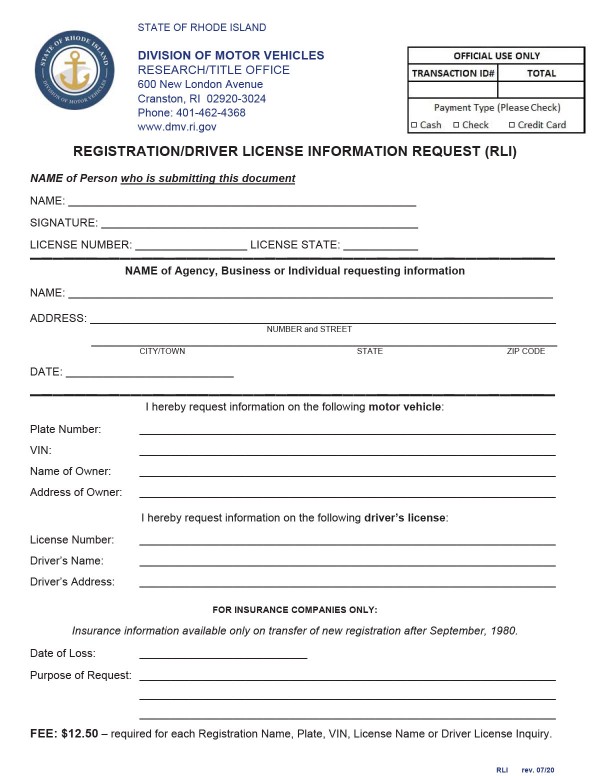

Find your gross income. If your taxable income is larger than 100000 use the Rhode Island Tax Computation Worksheet located on page T-1. A Rhode Island employer must with-hold Rhode Island income tax from the wages of an employee if.

As you can see your income in Rhode Island is taxed at different rates within the given tax brackets. Rhode Islands 2022 income tax ranges from 375 to 599.

Chart 2 Colorado Tax Burden By Type Of Tax Fy 1950 To 2016 Jpg Types Of Taxes Income Tax Chart

Prepare And Efile Your 2021 2022 Rhode Island Tax Return

Estate Tax Ri Division Of Taxation

Rhode Island Estate Tax Everything You Need To Know Smartasset

Rhode Island Income Tax Calculator Smartasset

Rhode Island Income Tax Calculator Smartasset

Dunes Beach Westerly Ri Westerly Rhode Island Rhode Island Salt Life

Free Rhode Island Real Estate Purchase Agreement Template Pdf Word

Historical Rhode Island Tax Policy Information Ballotpedia

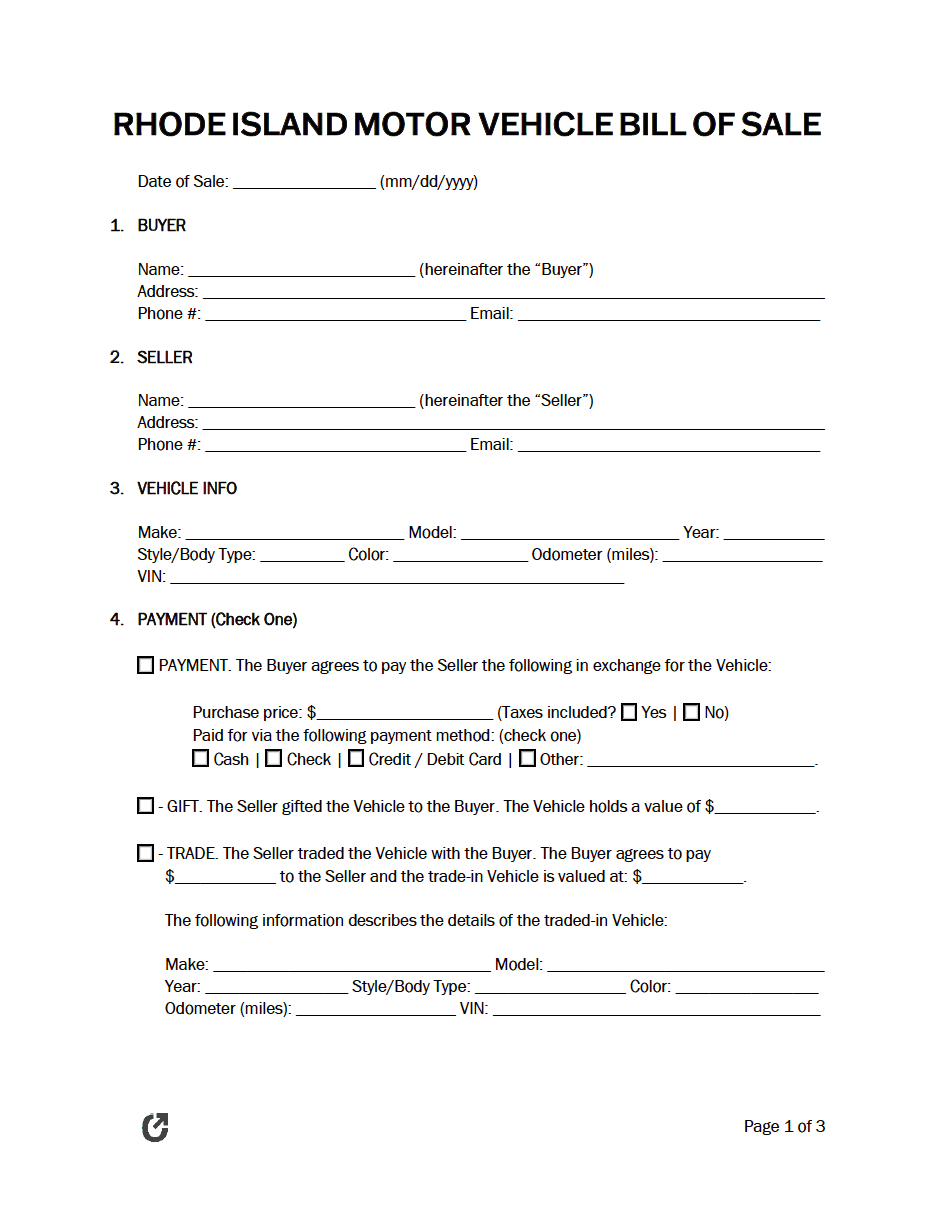

All About Bills Of Sale In Rhode Island Facts You Need In 2020

Rhode Island Ri Tax Refund Tax Brackets Taxact Blog

Free Rhode Island Bill Of Sale Forms 5 Pdf Word Rtf

Amazon Com College Flags Banners Co Rhode Island Pennant Full Size Felt Sports Outdoors