santa clara county property tax assessor

By using this service in any form the upper agrees to. MondayFriday 900 am400 pm.

Santa Clara County Planning Department Online Property Profile

The bills will be available online to be viewedpaid on the same day.

. The Assessor has developed an on line tool to look up basic information such as assessed value and assessors parcel number APN for real property in Santa Clara County. Some property andor parts thereof may be subject to. Business and personal property taxpayers in Santa Clara County now have access to SCC DTAC a new mobile app launched by the County of Santa Clara Department of Tax and Collections to.

Last Payment accepted at 445 pm Phone Hours. The 20222023 Secured Annual property tax bills are expected to be mailed starting October 1 2022. The bills will be available online to be viewedpaid on the same day.

Property Tax Email Notification lets you. Look up and pay your property taxes online. The Controller-Treasurers Property Tax.

The 20222023 Secured Annual property tax bills are expected to be mailed starting October 1 2022. The Assessor is responsible for establishing assessed values used in calculating property taxes and maintaining ownership and address information. The 20222023 Secured Annual property tax bills are expected to be mailed starting October 1 2022.

Department of Tax and Collections. CA State Tax Board of Equalization Property Tax Rules. Use the courtesy envelope provided and return the appropriate stub.

The bills will be available online to be viewedpaid on the same day. Send us a question or make a comment. The 20222023 Secured Annual property tax bills are expected to be mailed starting October 1 2022.

MondayFriday 800 am 500 pm. Pay Property Taxes. Review property tax bills any place with an internet connection.

East Wing 6th Floor. Office of the Tax Collector. The tax rate itself is limited to 1 of the total assessed property value in addition to any debts incurred by bonds approved by voters.

Get email reminders that your taxes are due. 408 299 5500 Phone 408 297 9526 Fax The Santa Clara County Tax Assessors Office is located in San Jose California. The bills will be available online to be viewedpaid on the same day.

San Jose CA 95110-1767. All data contained here is subject to change without notice. Frequently Asked Questions FAQs CA Code of Regulations Title 18 Chapter 1 Subchapter 3 Article 1.

---- DISCLAIMER ----This search site is provided as a service to our customers. Pay your Property Tax bill online. County of Santa Clara COVID-19 Vaccine Information for the Public.

San Jose California 95110.

House And Property Research San Jose Public Library

Assessor Santa Clara County California Primary Election Ballot Voter Guide Tuesday June 7 2022 Voter S Edge California Voter Guide

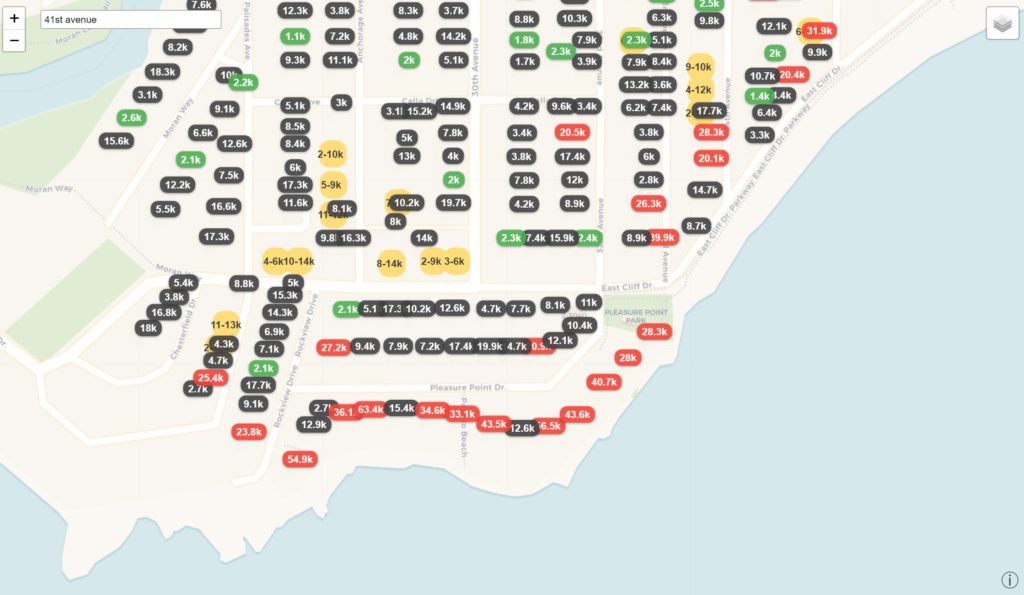

Maps Show Disparity In Santa Cruz County Property Taxes Santa Cruz Local

Official Map Of The County Of Santa Clara California Compiled From U S Surveys County Records And Private Surveys And The Tax List Of 1889 By Order Of The Hon Board Of Supervisors

Property Assessments Reach 551 5 Billion Peak Of Santa Clara County Economic Growth San Jose Spotlight

Property Tax Workshop Geared Toward Commercial Owners Morgan Hill Times Morgan Hill San Martin Ca

Santa Clara County California Ballot Measures Ballotpedia

Secured Property Taxes Treasurer Tax Collector

Santa Clara County Transfer Tax Affidavit Fill Out Sign Online Dochub

Property Tax Supplemental Tax Sakura Realty

Property Tax Email Notification Department Of Tax And Collections County Of Santa Clara

By Santa Clara County Controller Treasurer S Office Ppt Download

Elect Andrew Crockett Santa Clara County Assessor Vote By June 7th 2022 Elect Crockett

Santa Clara County Assessor Staff Wins Fight To Work From Home San Jose Spotlight

Santa Clara County Assessor S Office Warns Of Scam Against Homeowners

Larry Stone Assessor California State Association Of Counties